The New Carlsberg Foundation wishes to exercise good foundation governance and openness with regard to the foundation’s governance and decision-making, including tax. Accordingly, the foundation has published a description of its tax policy.

Income

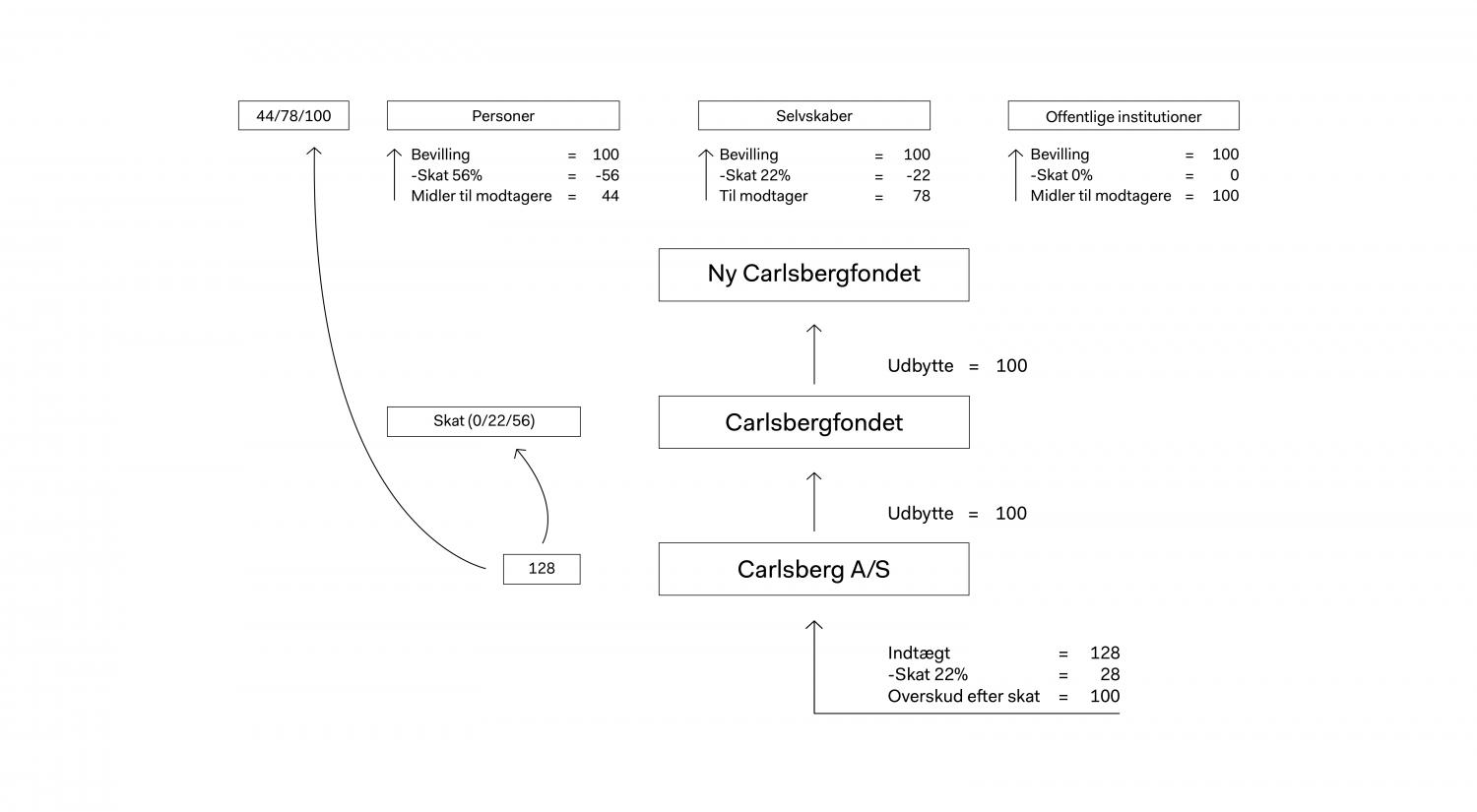

The New Carlsberg Foundation’s income derives from dividends from shares in Carlsberg A/S and return on the foundation’s other investments. Part of the dividends that the Carlsberg Foundation receives from its shares in Carlsberg A/S is passed to the New Carlsberg Foundation, as stipulated in the Carlsberg Foundation’s charter.

Profits from Carlsberg A/S are subject to corporation tax before they are paid out as dividends to the shareholders. The Danish corporation tax rate is 22%, and according to the most recent financial statement for Carlsberg A/S, the company had an effective tax rate of 24.7%.

Tax

Dividends received by the New Carlsberg Foundation are taxable at a rate of 22%. The foundation invests its frozen and free capital in securities until the funds are paid out as donations. The return on the foundation’s investments are also taxable at a rate of 22%.

Donations, on the other hand, qualify as deductions. Thus, as long as the foundation pays out the donations that it has deducted from its taxable income, measured over a five-year period, the foundation is not liable for tax on the dividends received from Carlsberg A/S.

Taxation of donation recipients

Taxation of the recipients of donations from the New Carlsberg Foundation depends on the recipient’s individual tax status.

Individuals who are taxable in Denmark typically have to pay up to 56% in tax on any donations received. Danish companies that receive donations from the foundation have to pay corporation tax, currently 22%, on received donations. Public institutions and museums that receive donations from the foundation are not typically liable to taxation of donations.